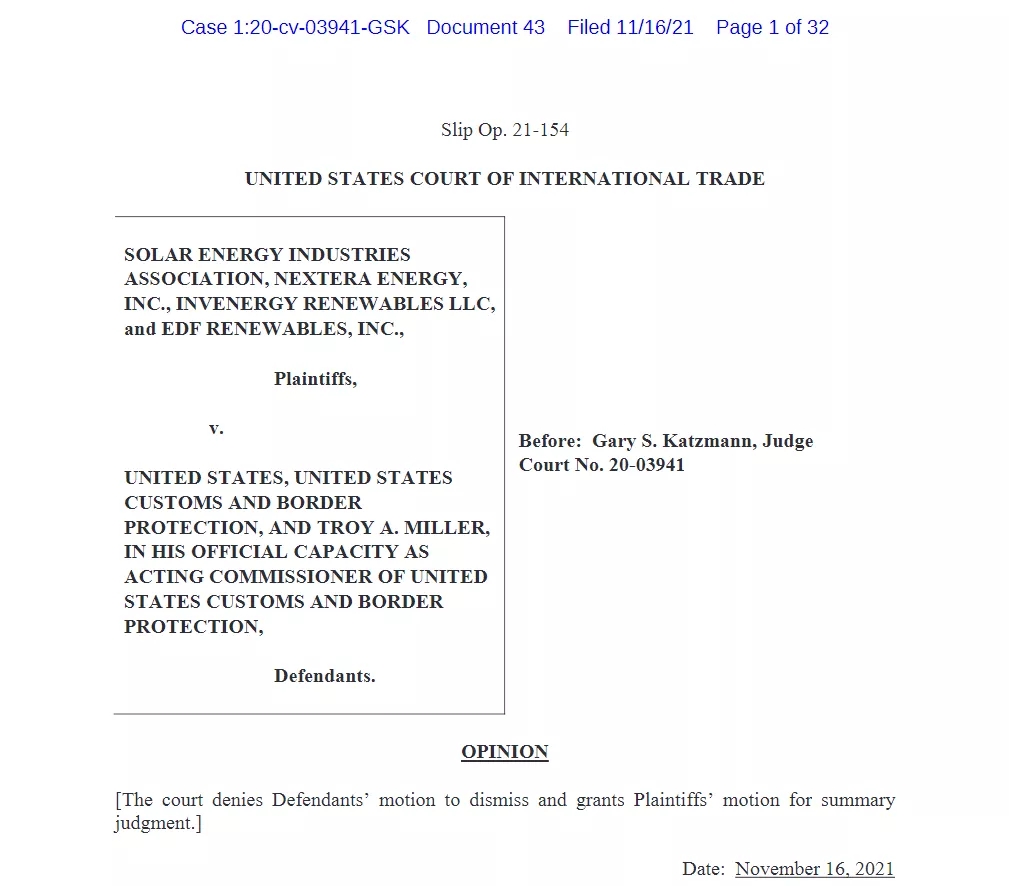

BIG NEWS! THE UNITED STATES EXEMPTS DOUBLE-SIDED MODULE TARIFFS AND LOWERS THE 201 TARIFF RATE!

On November 16, the U.S. Court of International Trade (CIT) officially announced the restoration of the 201 tariff exemption for double-sided modules and the reduction of the 201 tariff rate. This means that bifacial solar modules can be imported into the United States without additional tariffs.

CIT announced that it will officially restore tariff exemption rights for bifacial modules and reduce the Section 201 tax rate from 18% to 15% (previously, the tax rate was increased to 18% in Announcement 10101 during Trump’s administration). Under the changes, the additional tariffs previously levied will be refunded to relevant companies.

CIT said, “The previous Announcement No. 10101 revoked the tariff exemption for double-sided solar panels and increased the guarantee responsibility for CSPV modules. This not only constitutes an obvious misunderstanding of the legal regulations, but also exceeds the President’s authorization. Range.

The tariff exemption policy will benefit China's pv module exports. Bluesun Solar supply complete solar energy system with all accessories,like solar panels, solar inverter, solar battery, solar mounting brackets etc. More information, welcome to contact us at any time.

Sample Block Quote

Praesent vestibulum congue tellus at fringilla. Curabitur vitae semper sem, eu convallis est. Cras felis nunc commodo loremous convallis vitae interdum non nisl. Maecenas ac est sit amet augue pharetra convallis nec danos.

Sample Paragraph Text

Praesent vestibulum congue tellus at fringilla. Curabitur vitae semper sem, eu convallis est. Cras felis nunc commodo eu convallis vitae interdum non nisl. Maecenas ac est sit amet augue pharetra convallis nec danos dui.

Cras suscipit quam et turpis eleifend vitae malesuada magna congue. Damus id ullamcorper neque. Sed vitae mi a mi pretium aliquet ac sed elitos. Pellentesque nulla eros accumsan quis justo at tincidunt lobortis denimes loremous. Suspendisse vestibulum lectus in lectus volutpat, ut dapibus purus pulvinar. Vestibulum sit amet auctor ipsum.